Transforming dilemmas into decisions

Private wealth can be complex and demands a wide range of knowledge to manage it effectively. We advise many high-net-worth individuals and families, whether they are entrepreneurs or long-established estates, with interests both in the UK and abroad.

To safeguard your assets and your lifestyle, our private wealth team works alongside our Corporate and Commercial, Property and other colleagues to make sure we cover every pertinent aspect of your personal and business matters. This results in a seamless service, based on a deep understanding of what matters most to you.

What private wealth services do we offer?

Your personal, private wealth is a financial accumulation of all your hard work, investments and life savings over time. We understand that you want to protect these assets. At Sherrards, we can help you with:

- Probate, Intestacy and Estate Administration both domestic and cross-border

- Lasting Powers of Attorney and Deputyships

- Wills, Inheritance Tax and Estate Planning including issues of domicile.

- Tax Advice centered on the establishment and administration of trusts as well as Family Investment Companies

- Contentious Trusts and Estates and Private Wealth Disputes including Company Ownership Disputes

Our private wealth services costs guide can be found here, but due to the nature of Probate work and varying circumstances, we advise you to contact us for your bespoke quote.

Meet your private wealth legal team

Head of Private Wealth Head of Art & Heritage Arthur Byng Nelson Partner

Francesca Rossi Partner

Charles Burrell Senior Associate

Abroo Khan Solicitor

Rebecca Napier Associate

- Meet the whole team

Aisling Kelly Consultant Solictor

Amanda Newman Trainee Solicitor

Janice McKenzie Private Client Team Secretary

Emma Jeffery Secretarial Admin Assistant

Karen Timon Secretary

Maddie Collins Trainee Solicitor

Protecting private wealth worldwide

Our active participation in the Alliott Global Alliance means we are able to offer private wealth assistance globally. We frequently help clients who have assets across multiple jurisdictions.

We provide a seamless, one-stop approach to private wealth matters and can offer the expertise of our international teams for China and South-East Asia, Spanish, German and French-speaking countries.

Additional private wealth services

At Sherrards, our legal advice around private wealth extends beyond just probate, powers of attorney, wills & inheritance tax and tax advice.

- Advising you on property, which might be your personal home or an investment. We’ll explain all the tax implications and minimise their impact, and help with your acquisitions, sales and portfolio management.

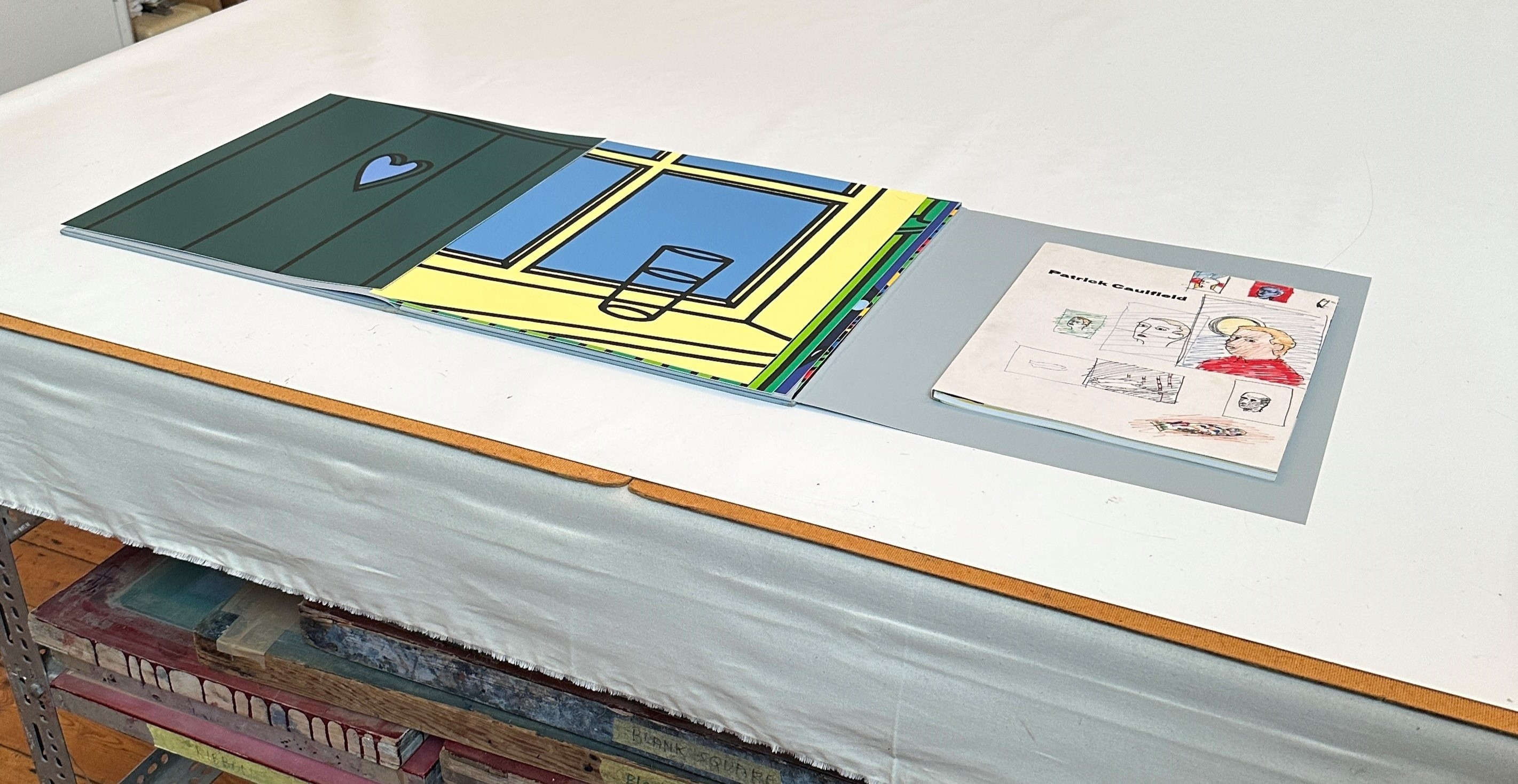

- Alternative investments. There may be areas you’ve yet to explore, such as art, classic cars, yachts or others. We’ll advise on values, likely returns, security and putting together a portfolio.

- Philanthropic giving. There’s an increasing enthusiasm for supporting environmental ventures, from preserving biodiversity to generating clean energy. We can direct you to those with the most promising potential or track records, and structure your support appropriately. We are also experienced in advising on and donating to a wide range of the more traditional charities.

- Family Investment Companies. Estate planning is something you’ll want to get right, but it can be difficult to decide on the right vehicle. Family Investment Companies are now often preferred to Trusts, and we can explain why, and help you set up your FIC for optimum tax efficiency. For more information, click here.

Discover more about safeguarding your assets, lifestyle and private wealth

Extraordinary Diaries of Field Marshal Lord Ironside Acquired by the Liddell Hart Centre for Military Archives at King’s College London

Case study Read more