23rd November 2023 | Arthur Byng Nelson | Inheritance Tax, Acceptance-in-lieu, Private Wealth

What is it the Acceptance-in-Lieu Scheme and how does it work?

Inheritance tax

As a general rule assets of a deceased over the value of the nil rate band (currently £325,000) are chargeable at 40% inheritance tax.

What is the Acceptance-in-Lieu scheme (“AIL”)

Since 1910 the UK government has encouraged those administering estates, responsible for ensuring that the tax is assessed and paid, to consider offering works of art and important heritage objects to the nation in lieu of inheritance tax.

In addition to the advantage of being able to meet a tax liability in kind, the scheme offers a financial sweetener (known as the douceur) to provide an even greater incentive to make use of the scheme.

The criteria

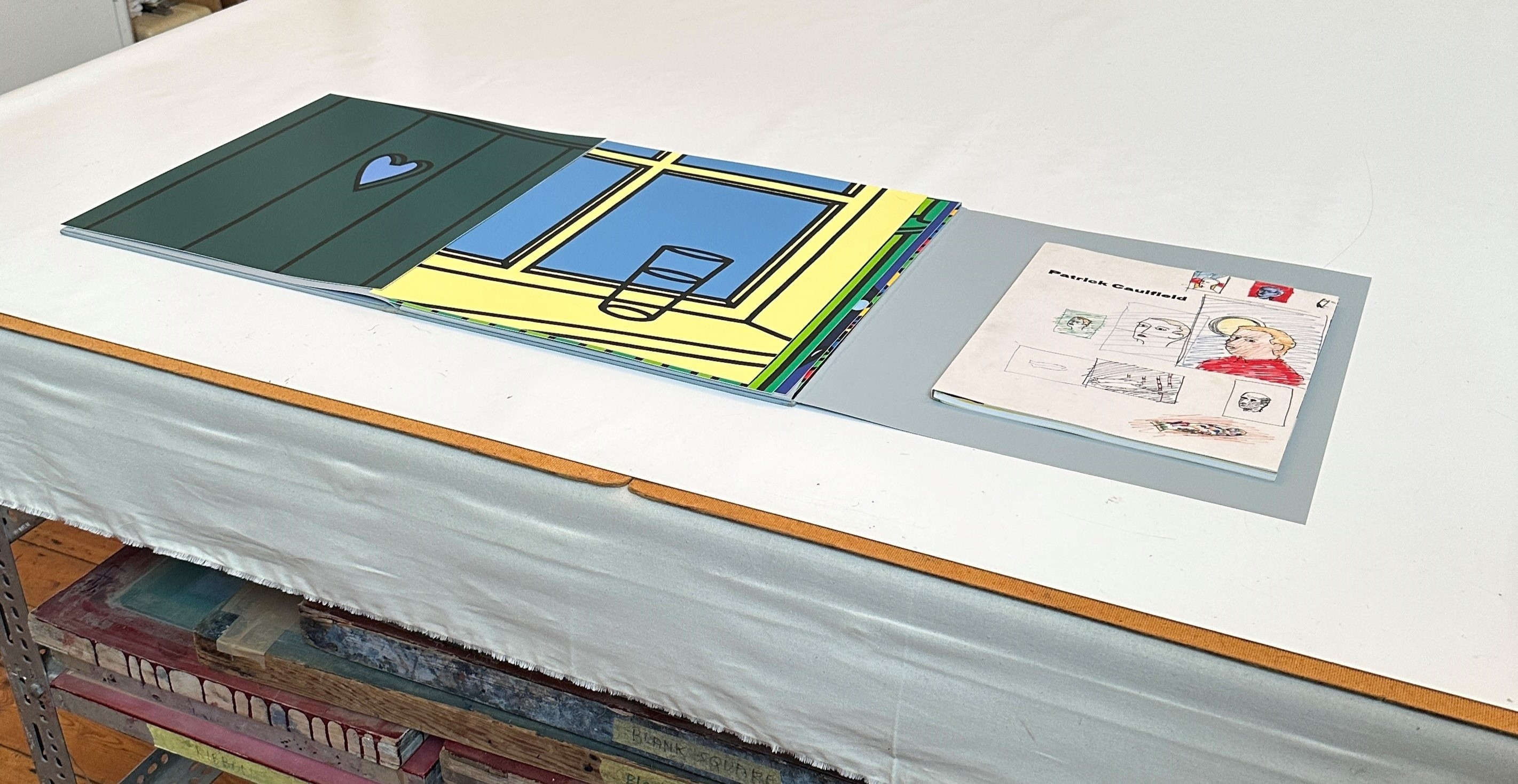

The art or objects must be ‘pre-eminent’: in other words, of particular historic, artistic, scientific or local significance, either individually or collectively, or associated with a building in public ownership. A very wide range of objects is accepted each year as may be seen in the annual reports published by the Arts Council.

The art or objects must be in an acceptable condition.

The Acceptance-in-Lieu Process

Offers must be made to the Heritage Team at HMRC. Those offers must be approved by the Secretary of State for Digital, Culture, Media and Sport (or the appropriate Minister in the devolved governments in Scotland and Wales) who is advised by Arts Council England’s AIL Panel. The AIL Panel consists of independent experts who seek specialist advice on the art or objects offered.

Key elements of any offer will be a valuation and justification for that valuation (generally independent opinion from more than one source is helpful); an explanation of why the object is considered pre-eminent; digital images and details of where the object can be inspected; evidence that the offeror has good legal title to the object (and details of its ownership between 1933-1945).

The Douceur

In order to attract some of the finest works into national ownership the government offers a financial incentive to those administering estates. The sweetener consists of a 25% “cash-back” calculated against the inheritance tax that would normally have been due.

Example: Mr Gombrich’s estate contains an important Modern British work on paper. At date of death the piece was valued by an independent expert at £100,000. The expected inheritance tax payable on that piece would be 40% of its value, £40,000. The net value to the estate after tax would therefore be £60,000. Mr Gombrich’s son is the sole residuary beneficiary and executor and faces a large inheritance tax bill on his father’s estate. Gombrich junior would like to use this work on paper to partially offset that inheritance tax bill and decides to pursue the acceptance in lieu route. The AIL Panel confirms the piece to be pre-eminent and agrees a value of £100,000. The douceur is calculated at 25% of the notional inheritance tax due on the painting of the painting: 25% x £40,000 = £10,000. That ten thousand pound figure is added to the net value figure to calculate the inheritance tax credit: £10,000 + £60,000 = £70,000. Gombrich junior therefore receives an inheritance tax credit of £70,000 for the piece and the nation gains a pre-eminent work for the public to enjoy.

Conclusion

Every case will be different. The scheme offers an opportunity to make a not-insignificant tax saving whilst also having the benefit making the item(s) available for the appreciation of the general public. At the same time do bear in mind that there will be occasions when an item might achieve a better overall result (tax liability included) when sold on the open market (or indeed by a private sale). If you are considering your options I would be very pleased to advise.